Consumer Duty Policy

At Intelligent Car Leasing we pride ourselves on being leading UK fleet management providers whilst offering the best combination of advice, products, competitive pricing and outstanding service.

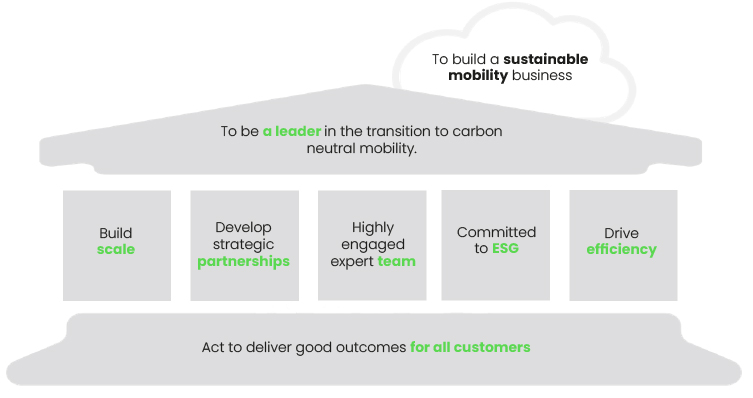

Our aim is best set out in our company purpose:

“To build a sustainable mobility business.”

Our strategic mission is to be the SME market leader in the transition to carbon neutral mobility. We aim to achieve this through our five pillars:

- Build Scale by improving our sales capability and increasing our marketing focus.

- Develop strategic partnerships that broaden the reach and scope of our business.

- Having a highly engaged expert team by developing our employees personally and professionally

- Committing to ESG (Environmental, Social and Governance) by formal monitoring of the key components and acting to continuously improve them.

- Driving Efficiency by investing in technology lead solutions.

All of these pillars are built on the foundation that we act to deliver good outcomes for all customers in everything that we do. To achieve this, we commit to:

- pro-actively acting to deliver good outcomes for our customers generally and put our customers’ interests at the heart of our activities;

- focusing on the outcomes our customers get, and acting in a way that reflects how consumers actually behave in the real world, better enabling them to access and assess relevant information, and to act to pursue their financial objectives;

- ensuring we have sufficient understanding of our customers’ behaviour and how products and services function to be able to demonstrate that the outcomes that would reasonably be expected are being achieved by those customers;

- where we identify that good outcomes are not being achieved, we act to address this by putting in place processes to tackle the factors that are leading to poor outcomes; and

- consistently and regularly challenging ourselves to ensure our actions are compatible with delivering good outcomes for customers.

All staff at Fleet Alliance must act to deliver good outcomes for our customers and treat them fairly. In order to achieve this, all staff are expected to demonstrate the following standards of conduct:

- act in good faith towards retail customers;

- avoid foreseeable harm; and

- enable and support retail customers to pursue their financial objectives.

Acting in Good Faith

This is a standard of conduct characterised by honesty, fair and open dealing, and consistency with the reasonable expectations of customers.

Fleet Alliance and customers both have a role to play if customers are to achieve good outcomes. However, when consumers deal with financial services firms, there is generally an imbalance in bargaining position, knowledge and expertise. Therefore, consumers can only reasonably be expected to take responsibility for their choices and decisions if we act openly and with honesty.

Our Commitment to our Customers

We will ensure we take account of our customers’ interests, for example in the way we design a product or present information.

We will not exploit consumers’ lack of knowledge or behavioural biases, such as tendencies to be influenced by the way things are presented, overvaluing immediate impacts and undervaluing future ones or attaching less weight to effects that are further off, such as early termination or excess mileage fees.

Examples of how we ensure that we act in good faith towards our customers include:

- Product Governance Forum: We have a Product Governance Forum (PGF) that reviews and approves all new and amended products and services to ensure they are designed to meet the needs, objectives and characteristics of the target market and offer fair value. The PGF also monitors the performance of existing products and services, including the outcomes experienced by our customers. Our senior managers participate in the PGF and its output is reported to the Board.

- Product Benefits and Risks: We have documented the benefits and risks of Contract Hire agreements and this must be shared with customers at the start of the sales process for their perusal. Sales staff should give customers enough time to read the document in their own time and make themselves available to discuss any aspect of it. The Benefits and Risks are also published on our website for customers to view at any time.

- Remuneration Structures: It is vitally important that our culture supports and is conducive to our staff acting in good faith. This includes ensuring that our staff incentives, performance management and remuneration structures do not encourage staff to act against customers’ best interests or cause them detriment. Our remuneration policy outlines that commission added to the lease is capped at 10% and this is strictly monitored by Compliance and reported to the Board. Performance-related bonuses include a quality metric and where staff do not achieve their call and file quality targets their bonus is reduced by up to 25%, thus incentivising staff to act in our customers’ best interests and treat them fairly. Additionally, we have a system control that requires sales staff to add a justification for not selecting the cheapest funder. All such exceptions are reviewed and monitored which ensures that one funder isn’t favoured over another.

Avoiding Foreseeable Harm

Firms can cause foreseeable harm to customers through their actions and omissions. This can occur not only when the firm is in a direct relationship with a customer but also through their role in the distribution chain even where their actions or omissions are not the sole cause of harm.

Whether harm is considered foreseeable would depend on whether a prudent firm acting reasonably would be able to predict or expect the ultimately harmful result of their action or omission in connection with the product or service.

Examples of how we will act to avoid foreseeable harm include:

- We ensure consumers are able cancel a product or service that isn’t right for them anymore and ensure our processes are not unclear or difficult to navigate.

- We prevent our products and services causing harm by implementing an appropriate distribution strategy which leads to products and services being distributed to customers for whom they are designed and whose interests they serve.

- We prevent consumers incurring overly high charges on a product by ensuring they understand the product charging structure and how it impacts on the value of the product.

- Consumers with characteristics of vulnerability are able to access and use our products and services properly because customer support is accessible to them.

- We ensure consumers don’t find it too difficult to switch to a better product or different provider because our process is too onerous or unclear.

Our Commitment to our Customers

We will take proactive and reactive steps to avoid causing harm to customers through our conduct, products, or services where it is in our control to do so. This includes ensuring that no aspect of our design, terms and conditions, marketing, sale of and support for our products or services cause foreseeable harm.

Examples of how we act to avoid foreseeable harm include:

- Customer Journey: We have mapped our end-to-end customer journey and identified all of the touch points and any areas where there could be foreseeable harm or unreasonable barriers to customers, and we have taken action to address these areas.

- Root Cause Analysis: We conduct root cause analysis on every complaint, issue and risk event to understand what caused it and to identify actions to prevent it from happening again.

- Annual Documentation Review: We review all of our policies and customer facing documentation at least annually to ensure that our policies and practices could not cause foreseeable harm and that our communications with customers are clear, fair, not misleading and enable them to make informed decisions. We will review documents sooner if evidence indicates potential harm.

- Redress and Remediation: We have a Redress and Remediation policy where we set out the steps we will take to investigate instances of actual or potential harm and how we will remediate the situation and offer redress to the customer where appropriate.

Enabling and supporting retail customers to pursue their financial objectives

This standard of conduct is concerned with the financial objectives of the consumer in relation to the financial product or service and applies throughout the customer journey and life cycle of the product or service.

This does not remove the responsibility that consumers have for their actions. But consumers can only take responsibility where they are enabled and supported to make informed decisions in their interests through firms creating the right environment.

As with acting to avoid causing foreseeable harm, the actions a firm might need to take to enable and support customers to pursue their financial objectives would be determined by what is within a firm’s control, based on their role and knowledge of the customer. The conclusions a firm can reach about the customers’ financial objectives will also depend on the type of product or service it provides. Where a firm provides a product or service on an execution-only or non-advised basis, customers’ financial objectives can be assumed by the firm to be the enjoyment and use of the product and service they have purchased. For example, a firm providing a personal contract hire product without financial advice might assume their customers have an objective of having the use of a new vehicle for a fixed period of time but without the option of owning the vehicle.

Our Commitment to our Customers

We will proactively and reactively focus on putting customers in a better position to make decisions in line with their needs and financial objectives. This includes recognising and taking account of consumers’ behavioural biases and the impact that characteristics of vulnerability can have on their needs.

Examples of how we enable and support customers to pursue their financial objectives include:

- Target Markets: We ensure that we obtain all the information we need from our funders to understand the identified target market and the characteristics of the product. The PGF assesses our target markets and distribution strategies to ensure they are aligned with those of the funders.

- Eligibility Criteria: Sales staff must assess during the first interaction with the customer that they meet the eligibility criteria for the contract hire product. Sales staff must assess the suitability of the product based on their understanding of the target market and the customer’s specific needs and objectives.

- Vulnerable Customers: Staff are trained to recognise vulnerabilities in customers and how to support them. Our staff are trained to tailor their approach to meet the customer’s needs and circumstances so that they experience outcomes as good as other customers and receive consistently fair treatment.

- Customer Support: Our customer service teams support customers after the point of sale, and we regularly review our processes to ensure that they do not cause unreasonable barriers or frustrate customers in enjoying the benefits of the product.

The Products and Services Outcome

Products or services that are poorly designed or distributed widely to customers for whom they are not designed can cause harm. Consumers can only pursue their financial objectives and avoid foreseeable harm when products and services are fit for purpose. Firms acting in good faith should design and distribute products and services to meet this aim.

Our Commitment to our Customers

We will ensure that the design of the product or service meets the needs, characteristics and objectives of customers in the identified target market.

We will ensure that the intended distribution strategy for the product or service is appropriate for the target market.

We will carry out regular reviews to ensure that the product or service continues to meet the needs, characteristics and objectives of the target market.

We have established a Product Governance Framework which comprises the following elements to ensure good governance throughout the product lifecycle (Design, Distribution, Monitoring, Continuous Improvement):

- Product Governance and Distribution Policy

- Product Governance Forum

- New and Amended Product Approval (NAPA) process

- Product Governance Controls

- Fair Value Assessment

- Product Governance Assurance Framework

- Commission and Fees Oversight

All of our products and services have been tailored to the needs of our customers based on market demand, competitive pricing, and customer feedback.

We continually assess and improve the services we provide to ensure we can meet changing requirements. Customer feedback is taken into account to ensure that we continue to meet and exceed customer expectations while maintaining competitive pricing.

The Price and Value Outcome

The specific focus of the price and value outcome is on ensuring the price the customer pays for a product or service is reasonable compared to the overall benefits (the nature, quality and benefits the customer will experience considering all these factors). Value needs to be considered in the round and low prices do not always mean fair value.

Retail customers experience harm where they don’t get value for their money. A lack of fair value is unlikely to be consistent with customers realising their financial objectives and firms cannot act in good faith if they are knowingly manufacturing or distributing poor value products or services.

Our Commitment to our Customers

We will assess value at the design stage and before offering products or services to consumers and ensure that the prices represent fair value for a foreseeable period.

We will monitor and assess the value of our products and services throughout their life and conduct reviews of our value assessment at least annually.

We will take appropriate action to mitigate and prevent harm where we identify that a product or service does not provide or ceases to provide fair value to customers.

The CEO leads an annual fair value assessment on the products and services we manufacture and co-manufacture. The assessment reviews our performance, charges, advice and overall service to our clients to ensure that the cost of product or service does not erode the benefits and overall value to our customers.

The PGF conducts an annual fair value assessment on the products it distributes on behalf of our panel of funders. The assessment reviews the performance, charges and overall service to our clients to ensure that the cost of the product does not erode the benefits and overall value to our customers.

The results of the fair value assessments are presented to the Board for approval.

The Consumer Understanding Outcome

The consumer understanding outcome rules retain the obligation under Principle 7 for firms to communicate information in a way which is clear, fair and not misleading. But they also build on, and go further than, Principle 7 by requiring firms to 'put themselves in their customers' shoes when considering whether their communications equip customers with the right information, at the right time, to understand the product or service in question and make effective decisions. An effective decision will usually be one that maximises the likelihood of a customer achieving a good outcome.

Communications should be understandable by the intended recipients and enable them to evaluate their options by assessing the benefits, risks and costs associated with those options, and how those options relate to their needs and financial objectives.

Our Commitment to our Customers

We will support our customers’ understanding by ensuring that our communications meet the information needs of customers, are likely to be understood by customers intended to receive the communication, and equip them to make decisions that are effective, timely and properly informed.

We will tailor communications taking into account the characteristics of the customers intended to receive the communication – including any characteristics of vulnerability, the complexity of products, the communication channel used, and our role.

We will tailor communications to meet the information needs of the customer when interacting directly with them on a one-to-one basis, where appropriate, and ask them if they understand the information and have any further questions.

We will test, monitor and adapt communications to support understanding and good outcomes for customers.

We have assessed our communication touch points throughout the end-to-end customer journey to ensure that customers are receiving the right information at the right time. We review all customer facing documentation at least annually to ensure that it is clear, fair, not misleading and includes all the information required to allow customers to make an informed decision.

All financial promotions are approved by Compliance before they are published.

All of our customer-facing staff receive annual training on how to recognise vulnerable customers and tailor their communications to support their needs.

We monitor our interactions with customers to ensure that customers’ enquiries are treated consistently, and that any advice given is in the customers’ best interests. This includes listening to calls and reviewing deal files to ensure that their circumstances have been taken into account. We regularly review management information, customer feedback, complaints, customer surveys and other metrics to provide assurance that our communications with our customers meet the expected standards. The Board are regularly updated on this activity.

The Consumer Support Outcome

The consumer support outcome rules set overarching requirements in relation to the support firms provide their customers. Consumers can only pursue their financial objectives where firms support them in using the products and services they have bought. A product or service that a customer cannot properly use and enjoy is unlikely to offer fair value. Firms should provide support that meets their customers’ needs. The support firms provide should enable consumers to realise the benefits of the products and services they buy, pursue their financial objectives and ensure that they can act in their own interests.

Our Commitment to our Customers

We will design and deliver support that meets the needs of customers, including those with characteristics of vulnerability.

We will ensure that customers can use their products as reasonably anticipated.

We will include appropriate friction in customer journeys to mitigate the risk of harm and give customers sufficient opportunity to understand and assess their options, including any risks.

We will ensure that customers do not face unreasonable barriers (including unreasonable additional costs) during the lifecycle of a product or service.

We will monitor the quality of the support we are offering, looking for evidence that may indicate areas where we fall short of the outcome, and act promptly to address these.

We will not disadvantage particular groups of customers, including those with characteristics of vulnerability.

We have dedicated customer service teams and we closely monitor the service levels to ensure that we have sufficient resources to adequately support customers throughout the lifecycle of a product or service after the point of sale – in particular, if they want to make an enquiry, complaint, cancel or make an in-life contract amendment.

Monitoring

We have a suite of MI that enables us to monitor the outcomes that our customers are receiving and investigate and take action where we identify potential or actual harm. The MI is reviewed by senior management and customer outcomes are reported to the Board. The suite of customer outcome MI is reviewed at least annually by the management team to assess if it remains fit for purpose or if there are any gaps or enhancements required.

The firm has a suite of defined Key Performance Indicators (KPIs) and Key Risk Indicators (KRIs) that are reported to the various governance meetings. The KPIs and KRIs are documented in the Key Performance and Risk Indicator Database. The database is reviewed by the Board annually to ensure it is fit for purpose and to identify any gaps or enhancements. Evidence of the review and actions taken are recorded in the Board meeting minutes.

Our compliance monitoring programme includes regular deep-dive reviews on each of the four consumer outcomes in order to provide assurance that our activities and processes are delivering good outcomes, avoiding foreseeable harm, supporting our customers to pursue their financial objectives, and that we are acting in good faith.

Governance

Our Board of Directors holds ultimate responsibility for the firm’s compliance with the Consumer Duty. There is a Consumer Duty Champion on the Board who, along with the Chair and the CEO, is responsible for ensuring that the Duty is being discussed regularly and raised in all relevant discussions. The Consumer Duty Champion is Angela Robertson (Chief Financial Officer). Individual responsibilities for Consumer Duty are included in our Senior Managers’ Statements of Responsibility and are reviewed at least annually.

Conduct and consumer outcome MI is reported to the Board every month. Additionally, on an annual basis the Board reviews and approves an assessment of whether the firm is delivering good outcomes for our customers which are consistent with the Duty.

The assessment is compiled by Compliance with input from Management. The assessment will include:

- the results of the monitoring that the firm has undertaken to assess whether products and services are delivering expected outcomes in line with the Duty, any evidence of poor outcomes, including whether any group of customers is receiving worse outcomes compared to another group, and an evaluation of the impact and the root cause;

- an overview of the actions taken to address any risks or issues; and

- how the firm’s future business strategy is consistent with acting to deliver good outcomes under the Duty.

- Before signing off the assessment, the Board must agree the actions required to address any identified risks, or any action required to address poor outcomes experienced by customers and agree whether any changes to the firm’s future business strategy are required.

In addition, the following governance forums report directly to the Board.

- Heads of Department

- Compliance

- Product Governance

- Technology

- Environmental, Social and Governance (ESG)

- Remuneration Committee

Each of the meetings or forums has specific terms of reference which covers the frequency, membership, purpose and decision making and approval processes that are relevant to each one and how they feed into the Board meeting, which is the ultimate decision-making forum.

Enforcement

Staff who act in breach of this policy, or who do not act to implement it, may be subject to disciplinary action. Any deliberate or negligent breach of this policy will be treated as misconduct and dealt with in accordance with the company disciplinary policy. Breaches of the Consumer Duty and Conduct rules will be reported to the FCA in line with our Risk Event and Breach Notification Process.

BMS-P18.3.0524